In this article, we will discuss different Phases of the Crypto Market Cycle 2022.

More than anything else, human emotions drive the market.

There is no doubt that traders have been disappointed by the crypto market this year. Especially after such a bull market as we had in 2021, no one expected things to turn out the way they did. The crypto market cycle 2022 is full of unpredictable events, even for the best traders.

All financial markets experience market cycles. There is, however, a high level of volatility and a rapid pace in the crypto market. As a result, there is a great deal of change over time. Knowing the current crypto market cycle is essential for investors. Your strategy would be more focused and directed if you did this.

Understanding Crypto Market Cycle 2022 Phases

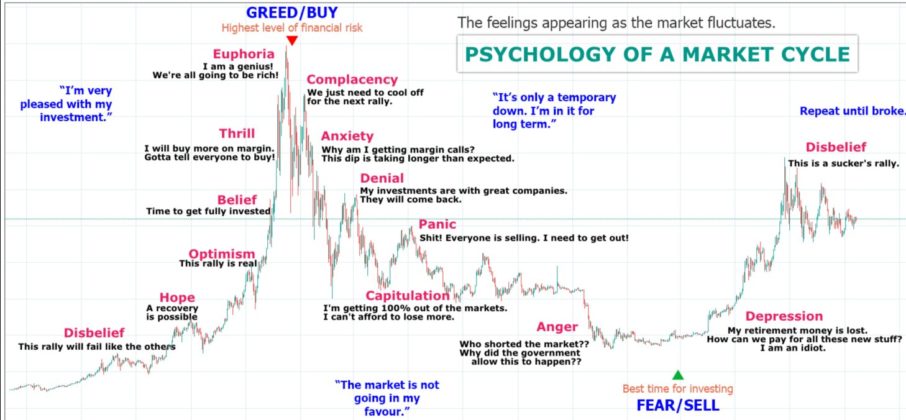

In addition to Bitcoin, there are other coins that go through market cycles. The term refers to the interval between two market highs or lows in conventional markets. In the conservative stock market, these cycles typically last for extended periods of time. According to Karen Bennett, a writer at CheatSheet, the picture above explains the psychology of the market cycle best. It was shared in a tweet by DeFi investor Route 2 FI.

Investors experience a variety of emotions during a fluctuating market period. In our financial markets, these human emotions play a larger role than the fundamentals, as simple as they seem.

The Crypto market cycle follows the same core stages over time, as illustrated in the image. It is important to note, however, that not every market cycle will follow this timeline. There is no hard and fast rule here. Market cycles should provide some interesting insights into the psychology of the market. During these phases, all markets experience short-term fluctuations. Listed below are brief descriptions of each phase:

1) Hope

It is the hope stage that signals a slow return to good times for the market. This stage follows “Disbelief” at the end of the cycle. There are positive indications of a bull run during the hope stage. Despite this, people remain cautious and concerned. As a result, they invest little in order to avoid huge losses.

2) Optimism

The optimism stage is when new capital enters the system and prices start to rise. After a long-term rise in the market, we reach the optimism stage. As a result, investors have a newfound faith in the market and inject cash into it.

3) Belief

As the trend continues upward, investors are beginning to look for new investment opportunities and ways to invest. The emotions change from optimism to belief. One of the core signs of a bull market is the belief stage.

Also Read: The majority of retailers expect to accept cryptocurrency payments within the next two years

4) Thrill

New opportunities in the market always excite investors who know their way around the market. The thrill stage is characterized by high emotions. Projects can be selected from a number of options. It is widely believed that there will be no decline in the near future. In other words, the market is open for business. At this stage, however, experts suggest you remain calm and reasonable and control your emotions.

5) Euphoria

Markets experience euphoria when a significant build-up has ended. At this point, the market is completely on the rise and nothing can dampen the already high emotions. This is where excess cash is a problem. Press articles about the newest crypto millionaires are also likely to be published. There will be a lot of media coverage of the bull market.

6) Complacency

There is no guarantee that the bull run will last forever. Other people will feel disappointed by their unfulfilled goals, while some will profit from it. This will result in the good run gradually declining. At this stage, the first signs of a market reversal begin to emerge. There is a common misconception that people are simply resting during the complacency stage before the bull run begins again. This makes this a very risky period. The impending market turn has caught many investors by surprise.

7) Anxiety

This is the point when people realize that “things don’t last forever in crypto.” They notice the market is turning around and is losing money and value. It is common for people to prefer to be in denial at this point in time. This method, however, may result in greater losses.

Also Read: During downturns in the crypto market, cryptojacking is at an all-time high

8) Denial

Even as investments continue to depreciate, many investors choose not to sell in hopes that the value will rise even more. The reason investors take a defensive stance at this stage is that they believe their funds have been invested wisely. The majority of investors at this stage believe they have invested their funds prudently, so they take a defensive stance. Unfortunately, not a single penny escapes unscathed in most cases. It is almost impossible to avoid getting wet in a storm.

9) Panic

Bear markets have established themselves as the new norm in this region. Unfortunately, things only get worse at this point, and there is nothing anyone can do about it. The result is that traders and investors sell their assets out of panic to reduce their losses and salvage their funds.

10) Depression

The market is losing its appeal to traders and investors at this point. In this area, there is little growth. It has even been reported that some traders get angry. The point at which stability and organization reemerge is here. However, it may take some time for things to return to normal.

It is difficult to predict the crypto market cycle. These cycles are influenced by risk, so it is important to recognize that it contributes to their duration and amplitude. It is safe to conclude that markets don’t rise or fall indefinitely. It is inevitable that they will go through different phases.

Via this site.