Across the crypto market, macroeconomic issues and implosions have taken their toll. The prices have been battered in this bear market and companies with massive customer bases have collapsed. Cryptocurrency prices came under pressure after the US Federal Reserve delivered another big interest-rate hike and warned of economic pain from the aggressive policy tightening still to come.

The US Federal Reserve delivered another big interest-rate hike and warned of economic pain from the aggressive policy tightening still to come. The US central bank increased borrowing costs for the 12th time in 2018, in a bid to curb further inflation. The Fed’s determination to raise rates to levels that hammer inflation at the cost of sliding asset prices sent a chill across global markets.

As the cryptocurrency market prices are warning us that a storm is brewing, it’s wise to batten down the hatches.

How does this affect market participants in the cryptocurrency space? Is there anything you can do to protect your wealth?

It seems increasingly likely that the US Federal Reserve FOMC will raise rates by at least 0.75%, with 1% a distinct possibility.

Also Read: What are the 10 best ways to spend cryptocurrency?

When it comes to fiat money, crypto investors have never been so fixated on the cost of borrowing money.

There is no doubt that the circulation of goods and services depends on an adequate supply of liquidity to lubricate the wheels of commerce. There are, however, risks associated with too much liquidity, and one of them is inflation.

A rise in inflation is the clearest sign of malaise, and crypto enthusiasts will soon shout “we told you so” – all that QE funny money is just postponing the crisis.

Nevertheless, the storm is such that it will engulf everything before it, including cryptos, so how can they prepare for it?

1. Make sure you don’t realize what you’ve lost

Don’t realize your losses by selling crypto – that’s the first rule of investing. Don’t sell unless you have to. We will moderate this later.

There is no doubt that your favorite portfolio management tool will be flashing red. In any case, if you are happy with your case for investing in all of those coins, you can stop firing up the app on the hour every hour. You might want to turn off some of those watchlist notifications as well.

Warren Buffett summarizes it well as he often does:

“The first rule of investing is not to lose money, and the second rule is not to forget the first.”

2. It’s not about timing the market, it’s about time in the market

The ultimate folly of trying to time when to enter and exit the market is also worth mentioning at this point. In general, the herd buys at the top and sells at the bottom.

In contrast, smart investors try to buy at the bottom – or at least when others are fleeing the market and decimating prices – and sell at the top.

It doesn’t mean that you should sell everything, go into cash, and then wait until the bottom is reached.

Despite Wall Street’s best attempts, active mutual funds don’t get those calls right, and they charge you top dollar for them.

Also Read: The ICON (ICX) buying process | How to buy ICON coin online

In order to remain successful, you must adapt and rebalance, which we discuss further below.

3. Learn how to become a crypto value investor

One of the reasons Warren Buffett hates crypto with a vengeance is that he is a classic value investor.

Apparently, he doesn’t know how to measure value in crypto because there are no earnings and, therefore, no dividends.

Despite generational prejudices, there are plenty of crypto companies that are producing earnings and paying dividends, so much so that the SEC has been knocking on the doors of some of those entities, or will be – look at your Ethereum Foundation!

Fundamentals, such as data storage, gaming, or value transfer, can be valued based on the value they represent.

In our case, we are looking for coins that are undervalued by the market. There’s no easy answer to that question since everything is undervalued at the moment. Yes, to a certain extent, but to a greater degree in some cases than in others.

Also Read: The ICON (ICX) price prediction for 2022, 2023, 2024, and 2025

How undervalued is the BNB coin?

There could be a case for arguing that exchange coins such as Binance Coin (BNB) are vastly undervalued since Binance is likely to emerge as an even bigger and more dominant exchange after the winter of crypto.

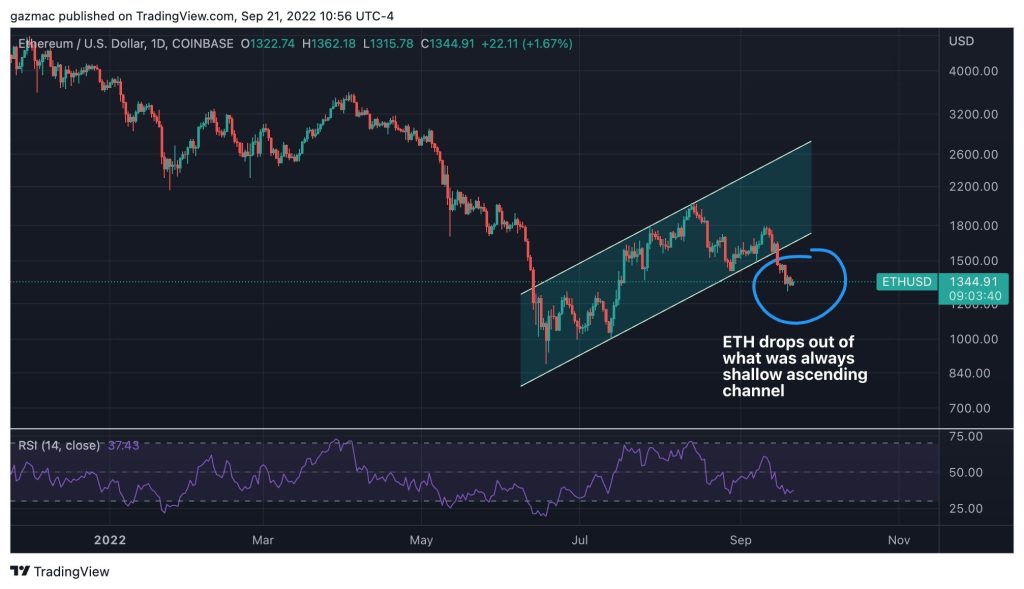

Does Ethereum have an undervalued price?

In light of its Merge upgrade, Ethereum may also be considered to be a uniquely undervalued network.

There is still a lot of work to do before Proof of Stake becomes a meaningful reality for end users, but from a value investor’s point of view, Ethereum has just been turned into a cash cow.

In the gaming industry, networks and games generate revenue for a host of companies. This trend is not showing any signs of slowing down – on the contrary, it is likely to accelerate.

Battle Infinity and Tamadoge are some of the new kids on the block, along with some of the network-level plays.

4. Take a bottom-up approach to invest

Make sure your approach isn’t too dogmatic. You should not let a bias toward certain sectors or subsectors blind you to a really good opportunity if you are taking the value approach.

Investors who invest bottom-up analyze companies on an individual basis, even if they operate in an unfavorable industry. Cryptocurrencies can be approached in the same way.

Even if you believe that central bank digital currencies are going to squeeze crypto cross-border payments at a commercial level, doesn’t that mean you should reject every opportunity that arises?

If Ripple wins its court case, what will happen? One of the leaders in space, its XRP token could experience a huge run-up in price and adoption could rocket.

5. Put an end to short-term thinking

Time is one of the differences between speculators and investors.

Speculators are looking for quick profits while investors look at the long term, which is typically measured in months and years rather than hours or days as it pertains to speculators.

One of Warren Buffet’s most famous quotes was:

Stock markets transfer money from impatient investors to patient investors. The same is true in crypto.

6. Make sure you run your winners

Unfortunately, many investors do not act rationally. Whenever a position goes into profit, there is a strong temptation to bank it.

It may seem logical, but investors frequently close winning positions too early, only to lose out on big profits in the future.

There doesn’t seem to be much choice between winners and losers when the market is moving downward like this.

The best performers in your total portfolio allocations will still contribute the most to future returns – they may still be the best performers in your total portfolio allocation.

Also Read: 3 Best ICON Wallets for staking ICX crypto in 2022

7. It’s time to cut your losses

Human psychology also works against the interests of smart crypto investors when we become emotionally attached to losing positions.

It’s important not to realize losses when you sell, but sometimes that makes sense if the situation can’t be recovered.

Among the 20,000 or so coins listed by coinmarketcap, there are some coins that are cheap for a reason.

Maybe the technology cannot be redeemed, user growth is irredeemably blocked, and the business model is irredeemable. You should leave if that is the case.

8. Passive income preserves capital

Inflation is running rampant and billions are disappearing from the markets every day. What is the best place to park your cash to prevent it from depreciating?

Government debt (Treasury Bills) and savings accounts used to be the answer. As a result, savings accounts still pay a pittance, and Treasury Inflation-Protected Securities, also known as Tips, are the only bonds worth investing in.

Cryptocurrencies provide a safe harbor for your wealth – staking.

As a result of the TerraUSD debacle, a bunch of crypto lenders imploded, giving staking a bad name. It is important to note that not all stakes are the same.

Cryptocurrency staking and algorithmic financial engineering are two separate things; staking your coins is one thing, and throwing them in the black box is another.

Invest in a network with demonstrated traction, such as Ethereum

Staking on Ethereum requires a minimum holding of 32 ETH, which is the threshold for becoming a validator and may be beyond the reach of many people.

If you include the burn effect which all ETH holders benefit from, you will earn enough – around 12% on average – to beat inflation.

In any case, you can entrust your ETH to some intermediary who will stake on your behalf, so you will receive less return, but it is still better than a savings account.

As for Ethereum alternatives, pick the protocols and service providers with the deepest pockets.

Although these entities may not yield the highest returns, they are much less likely to fail. In addition to Kraken, Coinbase, and Binance, many of these intermediaries can be found on the larger, more established crypto exchanges

9. Consider other asset classes as well (the whole picture)

According to professional investors, asset allocation is as important as compound interest.

A portfolio’s asset class weights (percentage of holdings) are more important than the stocks or coins it contains.

If you are an investor in crypto, you should consider how much of your wealth is in crypto and whether the amount feels comfortable to you based on your own risk profile.

Crypto represents 5% of your net worth, so if the market cap drops by 20%, you’re going to react differently than if it represents 50% of your wealth.

Crash opportunities are huge if you have cash on hand

A market crash can be a huge opportunity if you have cash on the sidelines and relatively small amounts invested in crypto.

On the other hand, if you are on the other side of the spectrum and are all in when it comes to your net worth, then your best bet is to hold on, but after the winter ends, take a look back and remember how you felt and add another asset class to your portfolio.

You might want to choose a crypto core with some larger satellite holdings so as to keep your blood pressure under control during the next seasonal storm.

10. There’s no need to panic

I know it sounds easy, but it’s not. By having a plan in place, you can avoid making panicked decisions later on. It is our hope that we have provided some pointers in that regard.

Via this site