Crypto market assets like Bitcoin receive more attention because of their speculative nature, which makes them less stable, but the general trend for most crypto assets is that they maintain their value over time, which makes them better hedges against inflation. Inflation is common and devastating, leading to devaluation of the currency or banknotes held in deposit. It is not just financial assets that can be affected by inflation.

For example, if you stored gold in a safe deposit box and then decided to use it as collateral for a loan if inflation crept up over time your assets now have less value than they did when you started the loan application process. Critics argue that the major reason for the increased institutional money in the crypto market is the overall price appreciation of cryptocurrencies over time. This has made investors complacent about the risks of investing in such volatile assets.

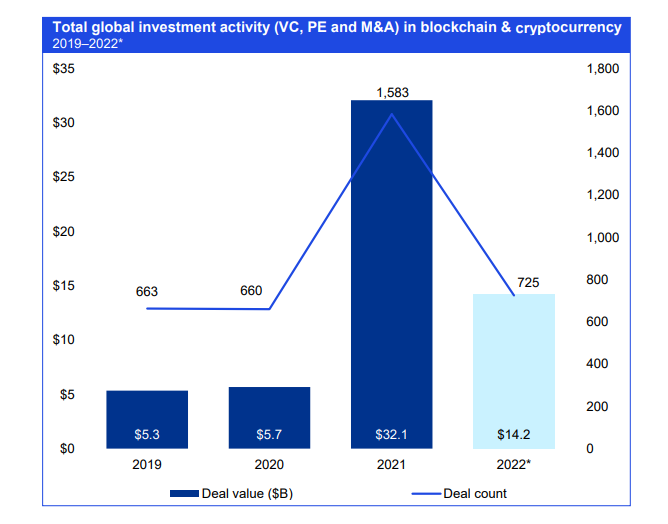

The crypto industry has seen more investments since the beginning of 2022 than in 2019 and 2020 combined despite the monetary crisis. KPMG International recently reported that the cryptocurrency market has shown signs of maturing in recent months, according to one of its reports. Russia and Ukraine are currently engaged in a military conflict, while inflation is at a record level in some countries.

Furthermore, most digital assets are trading below their all-time high levels from 2021, but investments in the space haven’t stopped despite this. A number of prominent companies have allocated billions of dollars to start-ups that are part of the ecosystem, including Trade Republic, Fireblocks, and FTX.

The Gruesome Reality

Many factors have directly or indirectly affected a significant part of the globe, including the COVID-19 health disaster, rising inflation, and the Russian-Ukrainian military conflict. The coronavirus pandemic took millions of lives and severely impacted the global financial system.

As a result of the stay-at-home rules coupled with the controversial printing of fiat currency by some central banks, a future monetary crisis was a foregone conclusion.

Consequently, Turkey, the UK, the USA, and other countries have experienced high inflation rates for decades. As a result of the Russia-Ukraine military conflict, the energy crisis has intensified in some regions since 2021 and is another factor that is contributing to the economic downturn.

In response to sanctions imposed on it, the world’s largest country withdrew some of its gas deliveries to several nations. In Europe, as winter approaches, there is more uncertainty as some states may not have access to enough energy supplies.

A number of financial markets, including the crypto sector, have been adversely affected by the negative trends. It is estimated that the global cryptocurrency market capitalization is around $1 trillion today, compared to $3 trillion in November of last year. One example is Bitcoin, which is roughly 70% lower than its ATH of less than a year ago.

Crypto Market Continues to Grow Despite This

Although the digital asset market has been declining, KPMG International believes it continues to mature. As a result of the uncertainty in traditional finance, a number of investors focused on the industry during the first half of the year.

Trade Republic – a German online broker that supports digital asset organizations – raised $1.1 billion to support its activities. It is estimated that Fireblocks’ valuation is $8 billion after securing a $550 million fundraiser. It is estimated that FTX is now worth over $32 billion, thanks to a $400 million Series E venture capital round closed by Sam Bankman-Fried’s exchange.

The crypto market has seen investments totaling $14.2 billion since 2022. There is a considerable difference between this amount and the $32.1 billion in 2021, but it exceeds what was raised in 2019 and 2020 combined.

It is important to note, however, that interest in the crypto industry in 2019 and 2020 was not as impressive. Bitcoin and many altcoins reached their all-time highs in 2021, which could explain the record investments.

A number of prominent companies began accepting payments in crypto, such as Expedia, PayPal, Rakuten, and Etsy, as well as giant institutions like Tesla, which bought billions of dollars worth of bitcoins.

El Salvador became the first country inside its borders to accept bitcoin as legal tender in September 2021, bringing the hype to a peak.

KPMG’s Crypto Market Efforts

Cryptocurrency industry interactions began in 2020. At the time, it launched a project called KPMG Chain Fusion, which helps traditional financial companies manage their digital assets.

By adding Bitcoin (BTC) and Ether (ETH) to its corporate treasury in February, KPMG’s Canadian subsidiary made its first cryptocurrency investments.

Soon after, Ian Taylor was hired as the company’s leader of its Web3 team. A member of CryptoUK’s Executive Director board, he has extensive experience in the cryptocurrency industry.

Via this site